Will $1 of Your Family’s Wealth Grow to $700 or $7,000 Over the Next 90 Years?

Are you being realistic about how your wealth should be invested for children and grandchildren?

Trust funding decisions can have HUGE tax consequences. After revocable and irrevocable trusts are designed and drafted, the attorney needs to fund the trust. Typically Schedules A and B (and sometimes additional schedules) will be attached with lists of assets. When the trust tax return is filed, income and capital gains from these assets will usually be taxable. If you pay taxes on trust income at typical rates, you could lose 1/3 of the gains to state and federal taxes while losing more than half of the dividend and interest income to taxes!

Very often clients hope to pass wealth to children and grandchildren. Over the course of the beneficiaries’ lives, the impact of taxes can seriously reduce compound growth rates. Consider, for example, the impact of paying 44% taxes on a 9% return over 50 years. At 9%, a million dollars can grow to more than $74 million; however, if the 9% is reduced by taxes, the million dollars might grow to only $11.5 million.

| Start | Rate of Return | Years | Value Today |

| $1,000,000 | 1.05 | 50 | $11,467,400 |

| $1,000,000 | 1.09 | 50 | $74,357,520 |

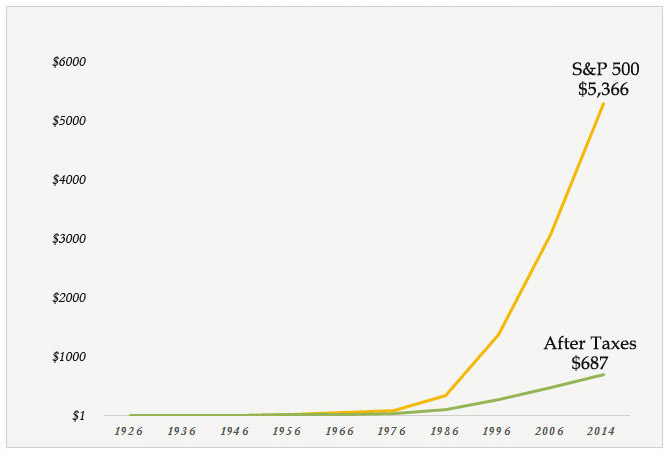

We can learn from a recent 92-year period. Good stock market return data has been accumulated since 1926. As of January 2018, we will have data from 92 years to update the following chart. It should be obvious that 1% invested tax-efficiently could have grown to more than $7,000. The same dollar invested in a taxable account might have grown to only a little more than $700.

Are your trust assets invested in tax-efficient vehicles. If not, ask your attorney to show you how you can invest more prudently throughout not just your life but also the lives of your children and grandchildren. Our attorneys are trained to build appropriate investment management language into trust documents. We can help improve the tax-efficiency of trust assets in the following ways:

- Review account statements to confirm that the correct trusts own each account in order to keep assets outside the taxable estate,

- Apply trust accounting principles to accumulate and distribute trust assets tax-efficiently,

- Confirm the accuracy of tax basis and market value numbers shown on the balance sheet,

- Determine that cash withdrawn from accounts for lifestyle needs will be taxed at the most favorable rates,

- Evaluate whether assets not kept liquid for lifestyle needs are invested tax-efficiently in longer-return assets,

- Estimate which rates of return to assume when designing tax minimization tools,

- Clarify whether asset management fees are tax deductible,

- Identify unnecessary taxes on portfolio rebalancing transactions,

- Integrate tax-efficient investments into portfolios, and

- Gather data to graph projected after-tax inheritance for heirs under different return/risk assumptions.

Seasoned advisors appreciate the opportunities that result from optimizing portfolios and then updating an estate plan in response to changing tax laws, cash flow needs, and asset values. This wealth optimization process may seem daunting as an advisor considers the use of hundreds of different legal tools and an even broader assortment of financial instruments that might fund each legal tool. Fortunately, the same advanced 21st-century economic system that produces the complexity also gives advisors solutions to the complexity in the form of sophisticated software programs that can evaluate myriad options while finding an optimal solution.

Family Office Law attorneys and paralegals teams up with portfolio planners, such as a registered investment adviser, to generate optimization reports. Our law firm staff members routinely clients minimize transfer taxes and reduce income taxes dramatically. These benefits can be illustrated graphically, such as is shown here:

Growth of $1 after Taxes over 90 Years

See assumptions behind the growth chart at: www.VFOS.com/webdocs/GrowthAssumptions.pdf